Can an SBA Loan Be Forgiven?

Table of Content

Defaulting on a loan due to a lack of repayment is much more common than violating the loan agreement terms. Small Business Administration and then issued by a bank or other participating lender. Several kinds of SBA loans exist to help businesses meet their goals from buying new equipment to purchasing land. Businesses usually grow from these loans and use their profits to pay back what they borrowed, but this isn’t always the case. If you’re unsure how to apply for an EIDL or PPP loan or how to use the funds so they can be forgiven – consult with an expert. An accountant will be able to provide answers specific to your situation and business.

Because you do have to repay EIDL loans, you may be wondering what repayment terms you might receive. EIDL loans come with a 3.75% fixed interest rate for businesses and a 2.75% fixed interest rate for private nonprofits. The maximum term length for COVID EIDL loans is 30 years. As a grant, the RRF does not need to be repaid, nor do recipients have to apply for forgiveness. As with the other grants we’ve covered, you will want to make sure you spend your funds on approved expenses to avoid being asked to pay back your grant. Usually, when people think of a COVID stimulus program with a forgiveness process, they’re thinking of the Paycheck Protection Program .

How much can I pay myself with EIDL loan?

Nora O'Malley covers small business finance and entrepreneurship topics for The Balance. Along with her writing work, Nora is an entrepreneur and consultant who opened an all-tap wine bar in New York's East Village dubbed Lois and owns a sophisticated snack food business Aida. For her businesses, Nora is responsible for finances, marketing, operations, and fundraising. Along with The Balance, her writing has appeared in Thrillist, Insidehook and Vinepair.

However, if you received your loan during the period when either of the Advance funds were offered and you were approved for either Advance, that portion does not have to be repaid. Loans made during the 2020 calendar year have a 24-month deferment window from the date of the note. Borrowers who received a PPP loan prior to the program closing on May 31, 2021 can now apply for forgiveness. The Supplemental Targeted Advance provided especially hard-hit businesses in low-income areas an additional $5,000 in grant money.

SBA loans that don’t qualify for loan forgiveness

The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. Ramp offers a free corporate card and finance management system for small businesses. Start earning rewards with your corporate spending today. No, funds received through the Targeted EIDL Advance are not taxable.

COVID EIDL loans are no longer available as of December 31, 2021. First, you must dissolve your business entirely and liquidate all business property. It’s better to offer as much as you can during the start of SBA loan settlement negotiations to avoid these unpleasant options. There are two ways for the SBA to collect the owned money. Either through the Treasury Offset Program or by cross-servicing.

Will SBA Covid loans be forgiven?

If you have a small business, you may qualify if your business was located in a declared natural disaster zone. If the SBA approves loan forgiveness, then you will not be legally obligated to repay the portion of your loan that was forgiven. When it’s clear that there are no remaining assets to support loan repayment, the SBA will likely issue an “offer in compromise” to borrowers who cannot fully repay their loan. An offer in compromise arrives via a form from the government and the business owner must propose a settlement amount within 60 days. Finally, business owners who receive loan forgiveness from it SBA will find it much more difficult to get approved for federal-based business loans in the future.

Clients also pledged their home as additional collateral. SBA OIC accepted for $87,000 with full release of lien against home. If you cannot repay or refuse repay, the SBA may seize assets from the personal guarantor of the business. Any owner with more than 20% state in the company would have signed as a guarantor and becomes liable.

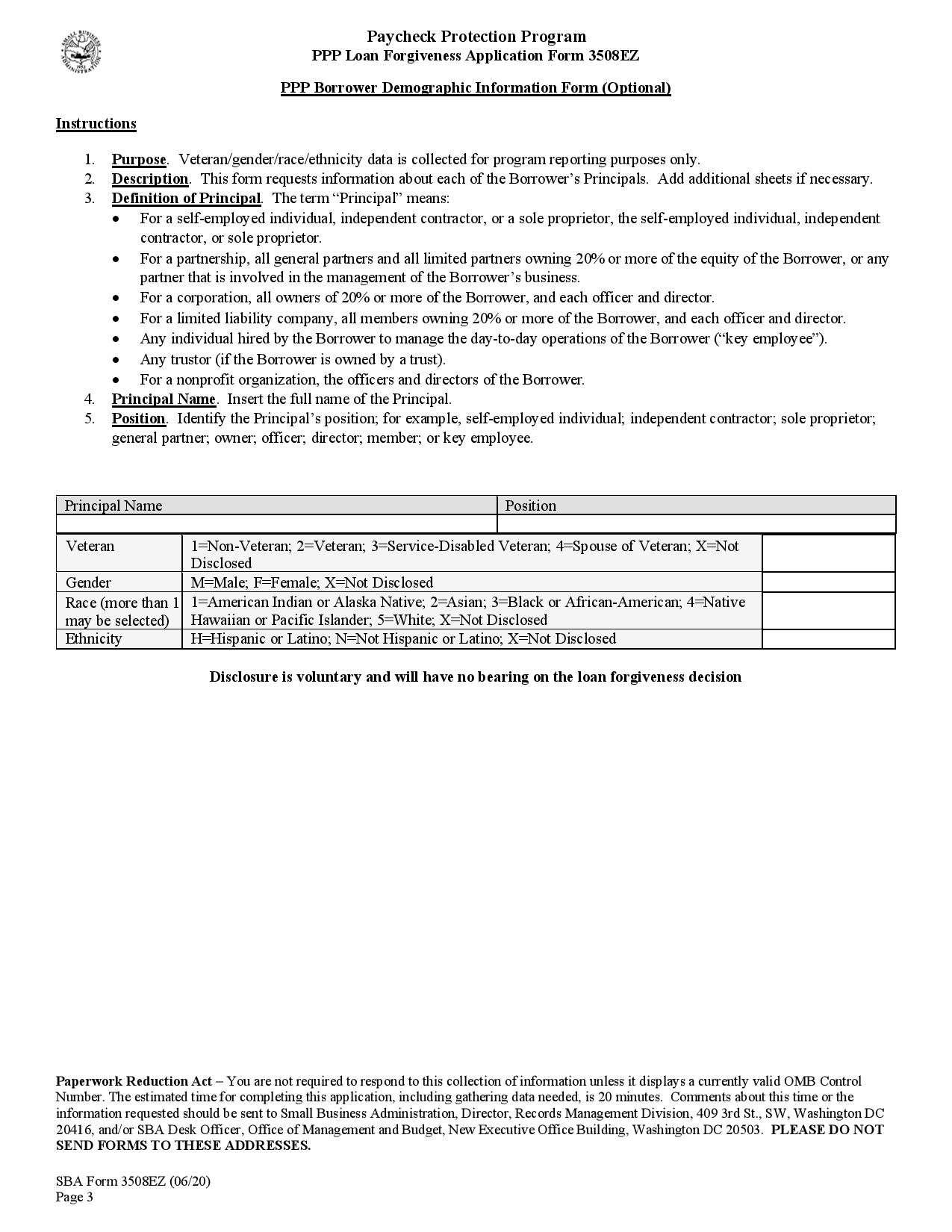

Paycheck Protection Program

If your business has less than 500 employees or if you’re a sole proprietor, you can qualify for both EIDL and PPP loans. However, there are critical differences in the amounts you can borrow. This is a secure service provided by United States Department of the Treasury. Browse hundreds of loan options, custom-tailored to your business and budget needs, from a single, simple platform. When your loan application is filled out and you’ve got all your documents attached, you’re ready to submit the application. PPP borrower forgiveness was originally outlined in the March 2020 CARES Act , but Congress has updated the rules in several later acts.

Borrowers can apply for forgiveness any time up to the maturity date of the loan. You also need to have maintained staffing and salary levels during your loan’s covered period. No, the SBA does not offer a forgiveness program for disaster loans. These loans must be repaid over 30 years with interest rates up to 8%, depending on your circumstances.

Good bookkeeping is essential if you want to achieve maximum forgiveness, so be sure to log your transactions in your books. Whether you use a bookkeeper or do it yourself, all transactions need to be recorded accurately. If the COVID-19 pandemic negatively affected your business and you had to take an SBA Loan to continue trading, you’re not alone.

Interest will continue to accrue on the loans during the deferment. If the loan was personally guaranteed by you or anyone else, the lender can call on any personal assets by garnishing wages or foreclosing on your home. SBA loans are generally attractive to small business owners because of their guaranties and interest rate caps. There are several ways you can make a payment on your disaster loan – by phone, by mail, and online.

Shortly after the passage of the CARES Act, the SBA announced that it would be auditing every borrower with a PPP loan in excess of $2 million. Loans now have a total deferment of 30 months from the date of the Note. Lendio is a free-to-use marketplace that allows you to compare lenders side-by-side. Ramp offers a free corporate card for virtually any business.

Comments

Post a Comment